Agent Digital Banking: A New Height In Banking And Finance Industry

The development of digital technology such as the Internet and mobile devices has provided the banking industry with modern service delivery channels and created the trend of branchless banking.

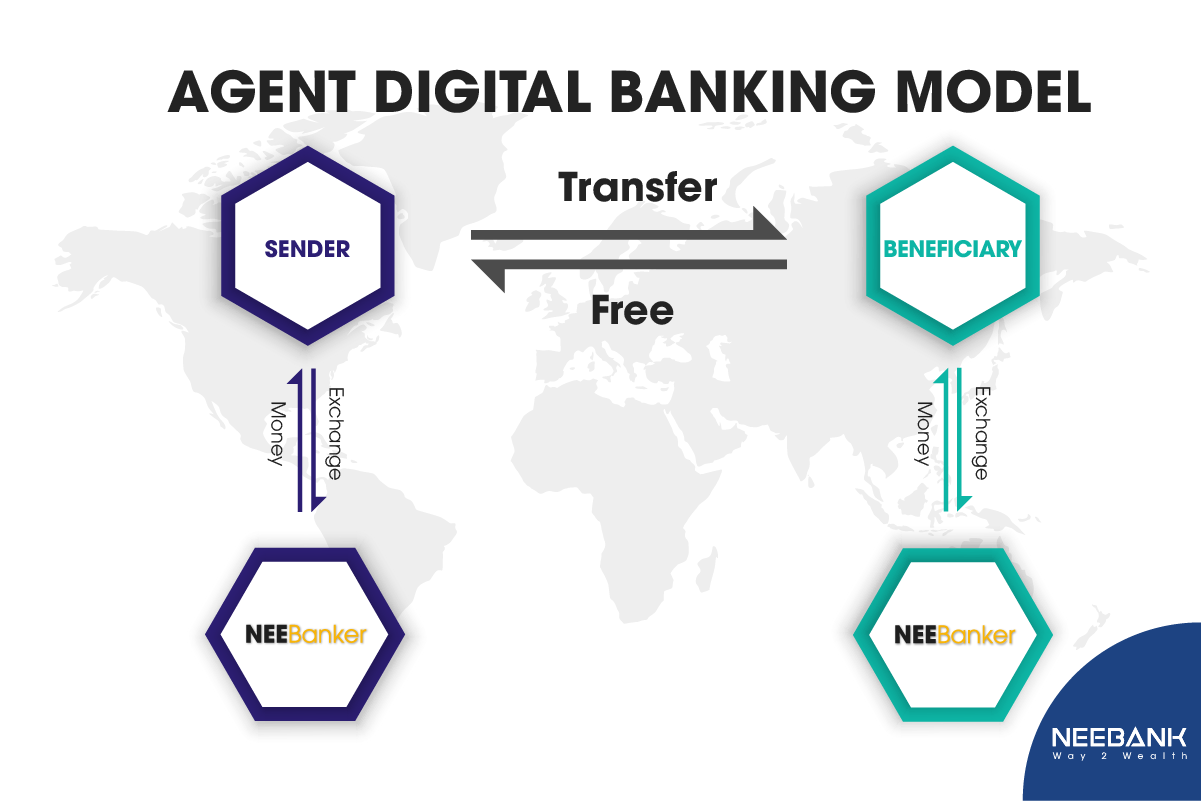

In this trend, customers can access the service conveniently without visits to a traditional bank branch. Over the past ten years, the world has developed a banking agent – a branchless bank model based on the application of modern technology. Following that trend, NEEBank has not only incorporated but also upgraded it to a new level with the model of AGENT DIGITAL BANKING – NEEBanker. This is a banking model without branches, offices or employees. It is operated completely online applying the most advanced technology such as decentralized platform (Blockchain), Internet of Thing (IoT), artificial intelligence (AI).

Although the traditional banking agency model has been present in many countries, only NEEBank has pioneered using a new model of the digital retail agent. As one of the innovative distribution channels to provide access and use of financial services, NEEBanker activities are considered the most outstanding initiatives for the global promotion of financial activities.

Table of contents

Who is a NEEBanker and what are his roles?

In general, an agency operation for a digital bank is to provide financial services to customers using a third-party partner on behalf of the mobile financial service provider.

An AGENT DIGITAL BANKING is considered one of the innovative distribution channels that help expand the access and use of financial services globally without being limited by space and time. NEEBanker is no longer restricted from enrollment; if the (traditional) banking agent is usually a grocery store, drug store, post office, or gas station, any individual can become a NEEBanker. It doesn’t matter if you are a worker, an office staff, an engineer, an accountant, or even a housewife, you can register to be a NEEBanker.

Through agents, basic banking services such as bill payment, cash withdrawal, money transfer, savings deposit, etc. and especially remittances are provided to people everywhere, even in remote areas where there are no commercial bank branches.

The strengths of the AGENT DIGITAL BANKING model

The AGENT DIGITAL BANKING model brings great benefits to financial institutions, customers and the agents themselves.

- The establishment and operation costs of agency channels are almost zero compared to traditional branch channels. The establishment of an agent is completely free of charge, as it is technically supported by NEEBank. At the same time, NEEBank does not have to pay fixed costs thanks to the availability of the agents which means no investment costs spent on infrastructure.

- It increases the access and its frequency to banking services of existing and new customers, thereby increasing the customer base and revenue for the bank. The agents are always close to where people live, so customers can easily access service providers without spending time and effort to go to a bank branch. Even poor or low-income people can reach bank agents.

- Agents get income from commissions for conducting financial transactions on behalf of a bank. At the same time, they are able to achieve higher revenues and income from their normal operations due to more customers coming to the facility when they become bank agents.

- From a national perspective, bank agents are currently the most effective way of improving access to financial services for people in remote and isolated areas where there are no branches, bank offices. It will soon become comprehensive financial leverage.

NEEBank desires for anyone to access and use banking services in the most convenient way, to break the boundaries that traditional banks are still facing – geographic problems and the working hours limits. At the same time, it aims at creating opportunities for business cooperation within the community. With all of the above, NEEBank has the ambition to quickly develop the NEEBanker community worldwide in the next 5 years.

See more about the policy of Agent Digital Banking – NEEBanker HERE: https://bit.ly/31K5wy7

The register link for a NEEBanker Account: https://neebanker.neebank.com/auth/signup?ref=neebankglobalhttps://neebanker.neebank.com/auth/login

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?