Crypto Knock Gold Out

Recently, the volatility of money 4.0 has helped it become an asset with the best growth rate since the beginning of the year.

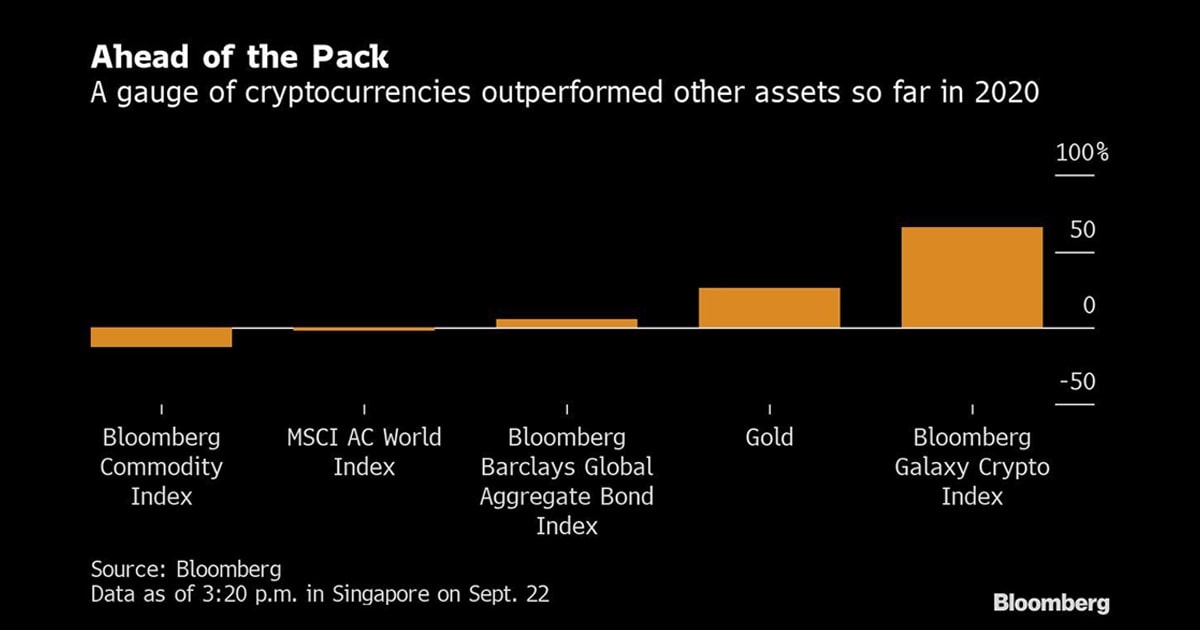

In 2020, crypto index has increased by about 66% (according to the Bloomberg Galaxy Index) compared with a rise of more than 20% of gold, Many experts warn the crypto market is often volatile. One of the reasons for this is the rapid advance of Ethereum, which accounts for more than a third of the weight of crypto.

The Crypto Index is up 66%, while gold is more than 20% (Image: Bloomberg)

In addition, a prominent figure in decentralized finance is DeFi, which has contributed to making money 4.0 the best performing asset this year.

According to Mike McGlone, strategist at Bloomberg Intelligence, the adoption of decentralized finance (DeFi) has fueled the rise of Ethereum.

DeFi is an ecosystem of financial applications built on top of a blockchain network. Here, users have full control over assets and interact through peer-to-peer, decentralized applications without the need for any central authority.

Users are allowed to carry out activities such as lending, borrowing money, earning interest from intermediate savings. The trend of using blockchain widely helps DeFi become more and more popular. Many DeFi applications run on the Ethereum blockchain.

According to Fasset, which operates a blockchain-based market for infrastructure investments, DeFi’s collateral has increased from $700 million earlier this year to $9 billion. In addition to DeFi, Bitcoin is also seen as an asset to hold prices amid huge stimulus packages against the impact of the pandemic that could cause inflation and weaken the dollar.

“The crypto market has been doing well during the Covid-19 crisis, in part thanks to Bitcoin being a gold-like ‘safe-haven’ asset,” Bloomberg quoted Marc Fleury, Chief Operating Officer. comments for Two Prime Cryptocurrencies and Financial Technologies and Asset Management.

“It’s a tool that works well when the economy stagnates,” he added.

In March of this year, Bitcoin price fell to a bottom of $4,904 due to market instability due to the impact of Covid-19 translation. However, by mid-May, the Bitcoin price rebounded to around $9,000 and surpassed a record of $12,000 in August.

According to CNN, market experts said Bitcoin appreciated due to the severe weakening of the USD. In recent months, the price of the greenback has plunged as the US Federal Reserve (FED) maintained low interest rates and the US economy receded because of the impact of the Covid-19 epidemic.

During a policy meeting on September 16, the Fed announced its decision to keep interest rates close to 0% until 2023. FED Chairman Jerome Powell issued a warning about an economy recovering slowly and in need of more support. from the government.

According to Powell, the Fed will maintain the current interest rates until the labor market recovers as expected and inflation increases by 2%. This is a long way when the number of Americans who lost their jobs since February still reached 11.5 million. The average inflation in the past 12 months is only 1.3%.

Trust in crypto

MicroStrategy CEO Michael Saylor said that after the Fed’s recent decision to loosen its inflation target, he transferred all of the company’s cash into Bitcoin.

“We are quite confident that Bitcoin is less risky than keeping cash, even safer than holding gold,” he commented.

Overall, investor interest in cryptocurrencies is growing as the derivative market for Bitcoin and Ethereum expands. “DeFi helps investors care more about Ethereum contracts. More and more cryptocurrency users are turning to derivatives to maximize their profits,” said Aziz Zainuddin, Product Manager at Fasset, comments.

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?