What ‘s an IBAN? How does an IBAN work?

Table of contents

What Is an International Bank Account Number (IBAN)?

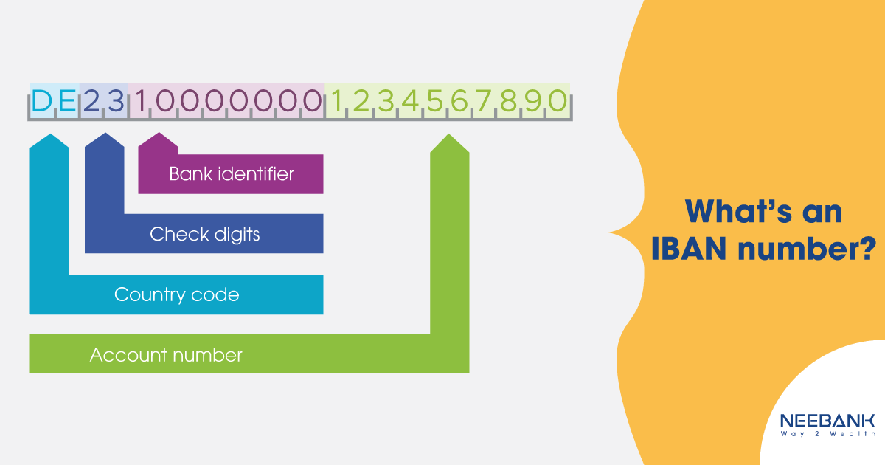

An IBAN, or international bank account number, is a standard international numbering system developed to identify an overseas bank account. The number starts with a two-digit country code, then two numbers, followed by up to third-five alphanumeric characters. However, an IBAN does not replace a bank’s own account number, as it’s only meant to provide additional information that helps in identifying overseas payments.

How does an IBAN work?

Above alphanumeric characters are known as the basic bank account number (BBAN). It is up to the banking association of each country to determine which BBAN they will select as the standard for that country’s bank accounts. However, only European banks use IBAN, although the practice is becoming popular in other countries.

International bank account number number will be used when sending interbank transfers or wiring money from one bank to another, especially across international borders. In the register of countries currently using the IBAN system, several examples are as follows:

- Albania: AL47 2121 1009 0000 0002 3569 87411

- Cyprus: CY 17 002 00128 00000012005276002

- Kuwait: KW81CBKU0000000000001234560101

- Luxembourg: LU 28 001 94006447500003

- Norway: NO 93 8601 11179474

The U.S. and Canada are two major countries that do not use the IBAN system; however, they recognize the system and process payments according to the system.

IBAN vs. SWIFT Codes

There are two internationally recognized, standardized methods of identifying bank accounts when a transfer is being made from one country to another: the International Bank Account Number (IBAN) and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code. The difference between the two methods lies in what they identify.

A SWIFT code is used to identify a specific bank during an international transaction, whereas IBAN is used to identify an individual account involved in the international transaction. Both play an essential role in the smooth running of the international financial market.

The SWIFT system pre-dates attempts to standardize international banking transactions through IBAN. It remains the method by which the majority of international fund transfers are made. One of the main reasons for this is because the SWIFT messaging system allows banks to share a significant amount of financial data.

This data includes the status of the account, debit and credit amounts, and details related to the money transfer. Banks often use the bank identifier code (BIC) instead of the SWIFT code. However, the two are easily interchangeable; both contain a mix of letters and numbers and are generally between eight and 11 characters in length.

Requirements for International Bank Account Numbers

The IBAN developed out of diverging national standards for bank account identification. Varying uses of alphanumeric forms to represent specific banks, branches, routing codes, and account numbers often led to misinterpretations and/or omissions of critical information from payments.

To smooth this process the International Organization for Standardization (ISO) published ISO 13616:1997 in 1997. Shortly after the European Committee for Banking Standards (ECBS) published a smaller version, believing the original flexibility allowed in the ISO version was unworkable. In the ECBS’s version, they allowed only upper-case letters and a fixed-length IBAN for each country.

Since 1997, a new version, the ISO 13616:2003, replaced the initial ECBS version. A subsequent version in 2007 stipulated that IBAN elements must facilitate the processing of data internationally, in both financial environments and among other industries. However, it does not specify any internal procedures, including but not limited to file organization techniques, storage media, or languages.

Related articles:

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?