Weekly Money 4.0 Technical Analysis

Table of contents

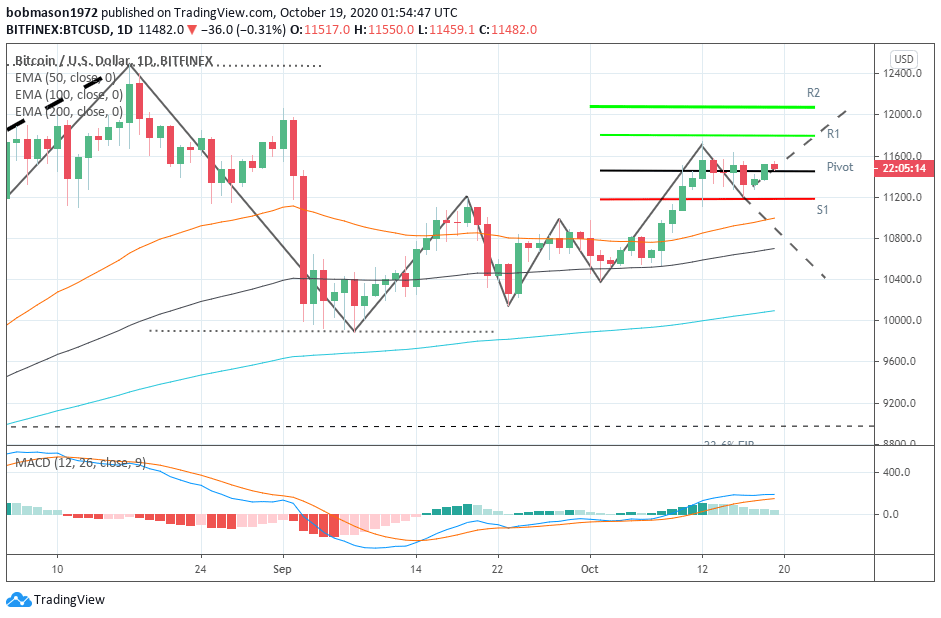

Bitcoin

Bitcoin rose by 1.18% in the week ending 18th October. Following a 6.53% gain from the week prior, Bitcoin ended the week at $11,518.

It was a choppy start to the week. Bitcoin fell to a Monday intraweek low $11,111 before finding support.

Steering clear of the first major support level at $10,782, Bitcoin bounced back to a Monday intraweek high $11,740.

Coming up against the first major resistance level at $11,746, Bitcoin fell back to $11,210 levels and into the red on Friday.

A relatively bullish end to the week, coming off the back of 2 consecutive days in the green delivered the upside for the week.

4 days in the green that included a 1.54% gain on Monday delivered the upside for the week. A 1.6% slide on Friday, limited the upside for the week, however.

The Week Ahead

Bitcoin would need to avoid a fall through $11,456 pivot to support a run the first major resistance level at $11,802.

Support from the broader market would be needed for Bitcoin to break out from last week’s high $11.740.

Barring an extended rally, the first major resistance level and last week’s high $11,740 would likely cap any upside.

In the event of a breakout, Bitcoin could test resistance at $12,000 before any pullback. The second major resistance level sits at $12,085.

Failure to avoid a fall through the $11,456 pivot would bring the first major support level at $11,173 into play.

Barring an extended sell-off, Bitcoin should steer clear of sub-$11,000 support levels. The second major support level sits at $10,827.

At the time of writing, Bitcoin was down by 0.31% to $11,482. A mixed start to the week saw Bitcoin hit an early Monday morning high $11,550 before falling to a low $11,459.

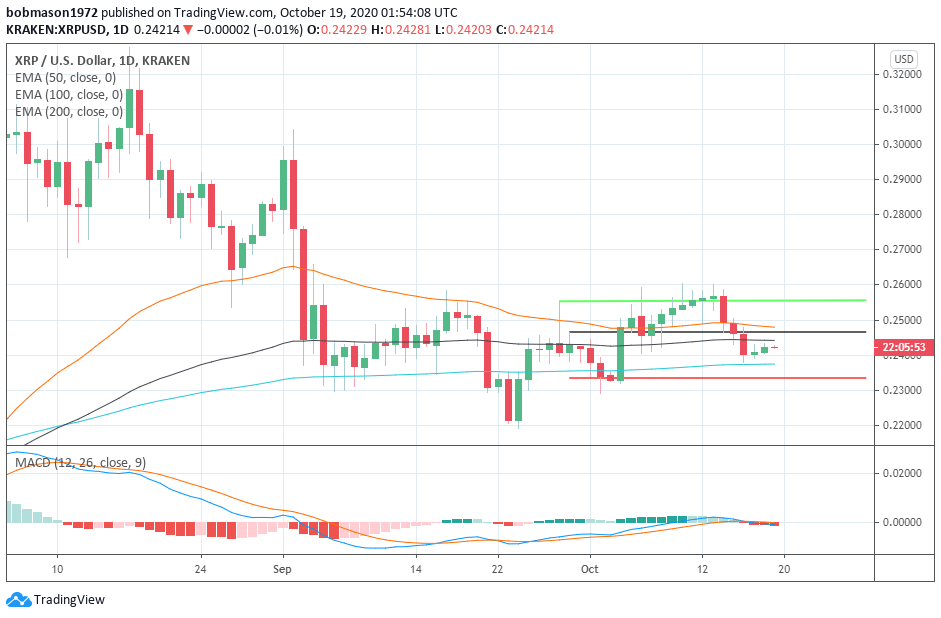

Ripple

Ripple’s XRP slid by 5.21% in the week ending 18th October. Reversing a 3.07% gain from the previous week, Ripple’s XRP ended the week at $0.24216.

It was a mixed start to the week. Ripple’s XRP rose to a Tuesday intraweek high $0.25998 before hitting reverse.

Falling short of the first major resistance level at $0.2638, Ripple’s XRP slid to a Friday intraweek low $0.23783 and into the deep red.

Ripple’s XRP fell through the first major support level at $0.2438 before finding support through the weekend.

In spite of 2 consecutive days in the green, however, Ripple’s XRP failed to break back through the first major support level.

3-days in the red that included a 2.89% slide on Tuesday and a 2.36% fall on Friday delivered the downside for the week.

The week ahead

Ripple’s XRP would need to move through the $0.2467 pivot level to support a run at the first major resistance level at $0.2555.

Support from the broader market would be needed, however, for Ripple’s XRP to break back through to $0.2550 levels.

Barring an extended rally, the first major resistance level and last week’s high $0.25998 would likely cap any upside.

In the event of a breakout, Ripple’s XRP could test resistance at $0.26 before any pullback. The second major resistance level sits at $0.2688.

Failure to move through the $0.2467 would bring the first major support level at $0.2333 into play.

Barring an extended crypto market sell-off, however, Ripple’s XRP should steer clear well clear of sub-$0.23 levels. The second major support level sits at $0.2245.

At the time of writing, Ripple’s XRP was down by 0.01% to $0.24214. A mixed start to the week saw Ripple’s XRP rise to an early Monday morning high $0.24281 before falling to a low $0.24203.

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?