Money 4.0

“Money 4.0 is an encrypted unit of intermediary assets used to exchange services and products. Simply it is similar to banknotes. Money 4.0 appears as a medium of exchange and multipurpose transactions according to the need to simplify commerce and the growing trend of human e-commerce. Developed based on Blockchain technology; which provided distributed data and is named after the issuer. All transactions take place entirely on the Internet technology environment. Value for money 4.0 is accepted and priced according to the real needs; and recognition of the community that accepts it”.

Table of contents

History of the money formation

Currency has evolved through many periods in the past and becomes more convenient for us to manage, operate and use. From the time when people formed the medium of exchange – commodities have so far gone through 7 currencies:

- Goods exchanged (Chickens exchange cows, buffaloes exchange sheep, …)

- Goods in exchange (shells / shells exchange goods among consumers, …)

- Gold coins (gold coins, gold bars, etc.)

- Metal money (coins)

- Banknotes (including polymers)

- Electronic money and electronic sale (electronic wallet, electronic payment, cards, …)

- Digital cryptocurrencies (Bitcoin, Ethereum, Libra, Paya, Nee, USDex, etc …) have their own international names Cryptocurrency

The currencies currently being circulated and used in the world are gold coins (3); coins (4), banknotes (5), semi-electronic and electronic money (6), and cryptocurrencies (6). (7) Currently, despite being born a long time from 2017 until now. Digital currencies are the most popular and has been become the global trend. Because the peak of this market has reached over 900 billion dollars.

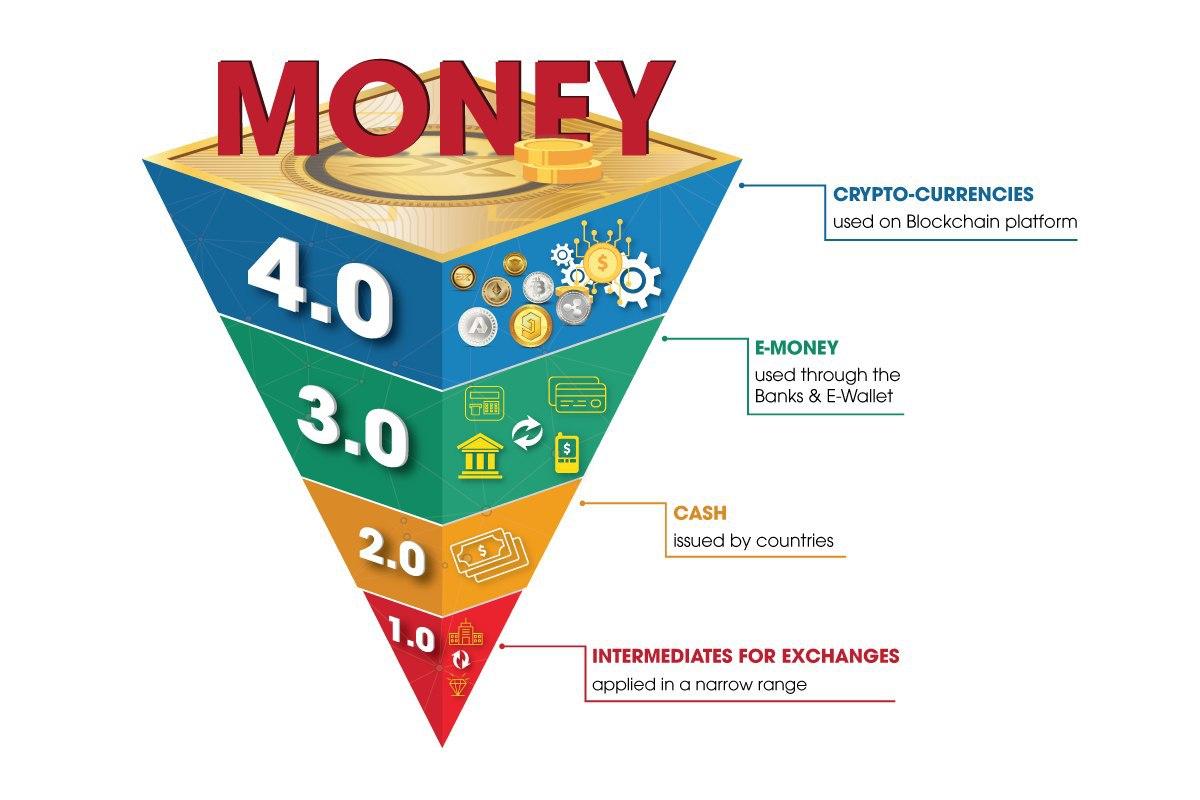

Based on the nature of use and classification according to the development process; money can be categorized into 4 main types that exist and develop.

There are 4 specific currencies as follows:

- Money 1.0 is an intermediary to exchange goods and services: Ex. Voucher, Tickets, cards, stocks, bonds, checks,… Or intermediary guarantee papers have the exchange of goods and services is limited.

- Money 2.0 is the physical money that we use every day (banknotes, polymers, precious metals, ..). Which is called the national currency, guarantee, direct issue from each country such as: USD, SGD, HKD, Yen, Euro, …

- Money 3.0 is an electronic number recognized by banks; and we exchange numbers via banks, mobile apps, internet banking, VISA, MasterCard, ATM, etc.

- Money 4.0 is a digital currency (Cryptocurrency): such as Bitcoin, Ethereum, XRP, Paya, NEE, USDex… . are stored on the blockchain and used entirely on the internet. Money 4.0 has all the characteristics of the 3 types of money but there are characteristics that 3 traditional currencies do not have: rarity, transparency, safety … and crossing all borders and limits … The trend of cashless world today is that we are using Money 3.0 and in the next 10-20 years Money will exist independently along with Money 3.0, which is a 4.0 currency in particular.

The rising era of money 4.0 with the potential opportunities

Like more than 10 years ago, the world hardly knew the value of Money 4.0 would bring the value it is today. The birth of Bitcoin and then many of the 4.0 currencies also confirmed the price. their exist value like ETH, XRP, PAYA, ….

The rise of the economy will be associated Money 4.0 will be the period to produce many billionaires and millionaires in the next decade (2020-2030).

How 4.0 money works?

The transition period from 2.0 to 3.0 takes about 20 years from 2000 to 2020. Time of money transfer 3.0 combined 4.0 from 2020 to 2030 (10 years)

In essence, operating money management 4.0 will be simpler and safer than a lot of money 3.0. And what is the time to jump for the development of Money 4.0?

The biggest limitation of Money 4.0 currently exists is the unopened legal barrier in most countries. Governments also need to find ways to protect their 2.0 currency to protect the national economy – domestic. So the introduction of Money 4.0 has confirmed its value and strength when in the end of 2017. The market capitalization of Money 4.0 exceeded the $ 900 billion threshold for the first time (December 2017). But due to the lack of backed by the government, money 4.0 has not been used in traditional banks. So people often consider money 4.0 to be outside the legal regulatory flow and it is called virtual currency.

There should be a banking institution that accepts Money 4.0 which will be a stepping stone for the rise of Money 4.0 in the coming decades. That is the revolution on bank 4.0 supporting the environment for money 4.0 development

The differences between Cryptocurrencies, Money and Money 4.0

- Cryptocurrencies: the physical properties of money – invention technology, money operation and techniques.

- Money: coinsor notes (= special pieces of paper) that are used to buy things; or an amount of these that a person has in certian time.

- Money 4.0: application of Money – Technology and the future trend of using Money in life. The habit of using from cash (cash 2.0) to cashless (Cash 3.0) and the inevitability of Money 4.0.

- Money 4.0 is the application – utility of Cryptocurrencies in life. Money 4.0 may also have a significant influence on inventions of another currencies.

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?