Asset Encryption: Bringing Real World Value To The Blockchain

Table of contents

Introduction

“Asset Encryption” is a term for the use of blockchain technology to represent ownership or rights to an asset as a tradable, on-chain token. Though it most commonly refers to the encryption of financial or fungible assets, such as shares in a company or a quantity of gold, asset encryption can hypothetically refer to the encryption of any material or nonmaterial thing possessing monetary value: everything from a piece of art to a patent to an hour of a skilled worker’s time. As such, asset encryption is among the most promising use cases for blockchain, with the upper bound of its growth potentially encompassing nearly all of the human economic activity — a dollar number estimated to be worth well over a hundred trillion annually.

Perhaps more impressive than the long-term promise of this use case are the strides towards adoption already being made today. In the past year alone, major enterprises have studied asset encryption and concluded that it possesses the capacity to disrupt multiple industries, specifically the 9 trillion-dollar annual global securities industry and the 9.6 trillion-dollar global real estate industry. Additionally, Microsoft, Vanguard, and Sotheby’s have announced or gone live with projects tokenizing industrial assets, securities, and real estate, respectively. By these metrics, asset encryption is already among the most popular blockchain use cases currently achieving real-world enterprise adoption.

At the heart of both the current success of asset encryption and its long-term potential is the remarkable number of advantages and additional utility that comes with encrypted assets relative to non-encrypted ones. Encryption can allow for increased liquidity of traditionally illiquid assets; greater accessibility and ease-of-access for otherwise cloistered investment opportunities; greater transparency regarding ownership and ownership history; and a reduction in administrative costs associated with the trading of these assets, including management, issuance, and transactional intermediaries. Finally, encryption allows for assets that previously could not access the ecosystem a path towards doing so, unlocking a whole new realm of potential through asset-backed composability.

As anyone familiar with the oracle problem knows, any instance where a blockchain needs to interact with the external world can present security risks and other complications, and asset encryption — a process that by nature relies on information about the world that is generally off-chain — is no exception. Secure oracles will be key for asset encryption to reach its full potential, as markets will need reliable information about the underlying assets in several key processes such as minting, trading, managing, and more.

Benefits of Encrypted Assets

In addition to offering a decentralized and trustless alternative to a real-world product, investment vehicle, or service, encrypted assets also actively improve the assets in a variety of other ways. Specifically, encrypted assets present a clear path towards making numerous assets more valuable, accessible, and useful relative to their legacy counterparts, as well as creating a vehicle by which off-chain data can augment their utilization within the ecosystem.

Liquidity

Fine art is often used as an example of a potentially high-value, but extremely illiquid asset. Due to their scarcity, pieces of fine art enjoy the so-called “liquidity premium” — the theory that low-liquidity assets yield higher returns over time. However, collectors who wish to sell their art are often put at a disadvantage because there may or may not be a robust market of buyers to accommodate a fair value sale. Because of this, the art world encompasses an entire sub-industry of middlemen whose primary function is to accommodate collector-to-collector or artist-to-collector exchange: galleries, dealers, auction houses, etc. This leads to significantly higher transaction costs relative to other assets — a pattern similar to other illiquid assets, such as real estate.

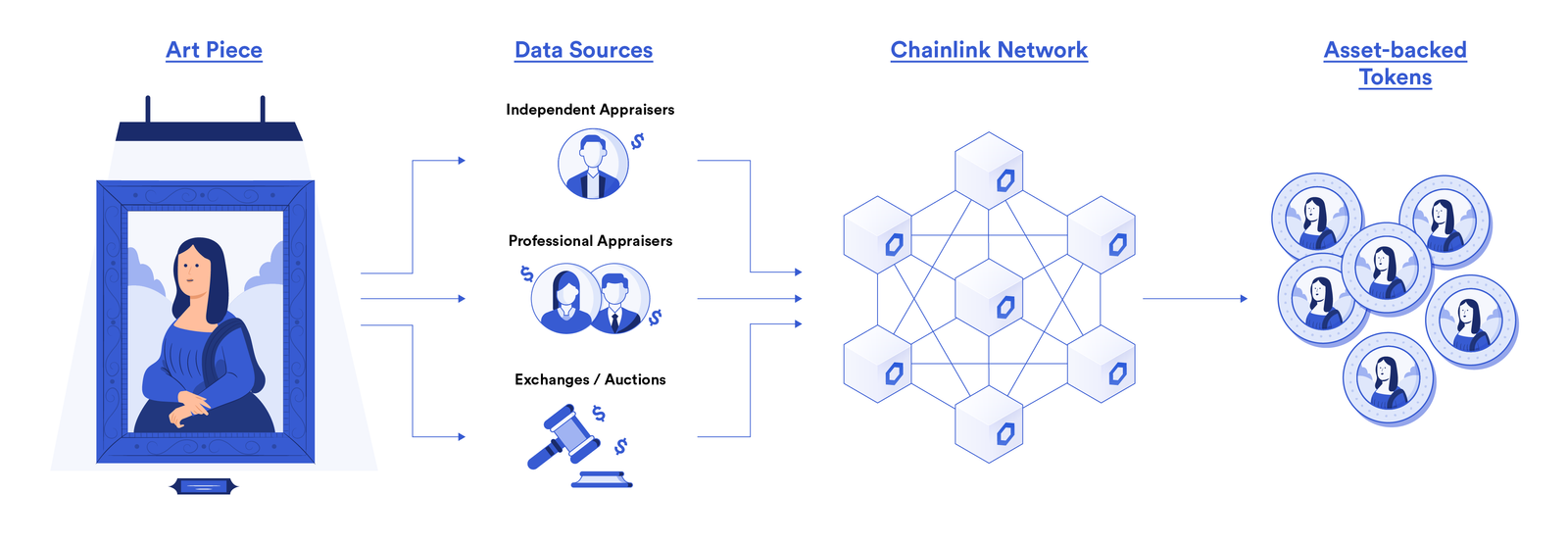

An example of how art can be tokenized and Chainlink oracles can provide on-chain valuations to these asset-backed tokens.

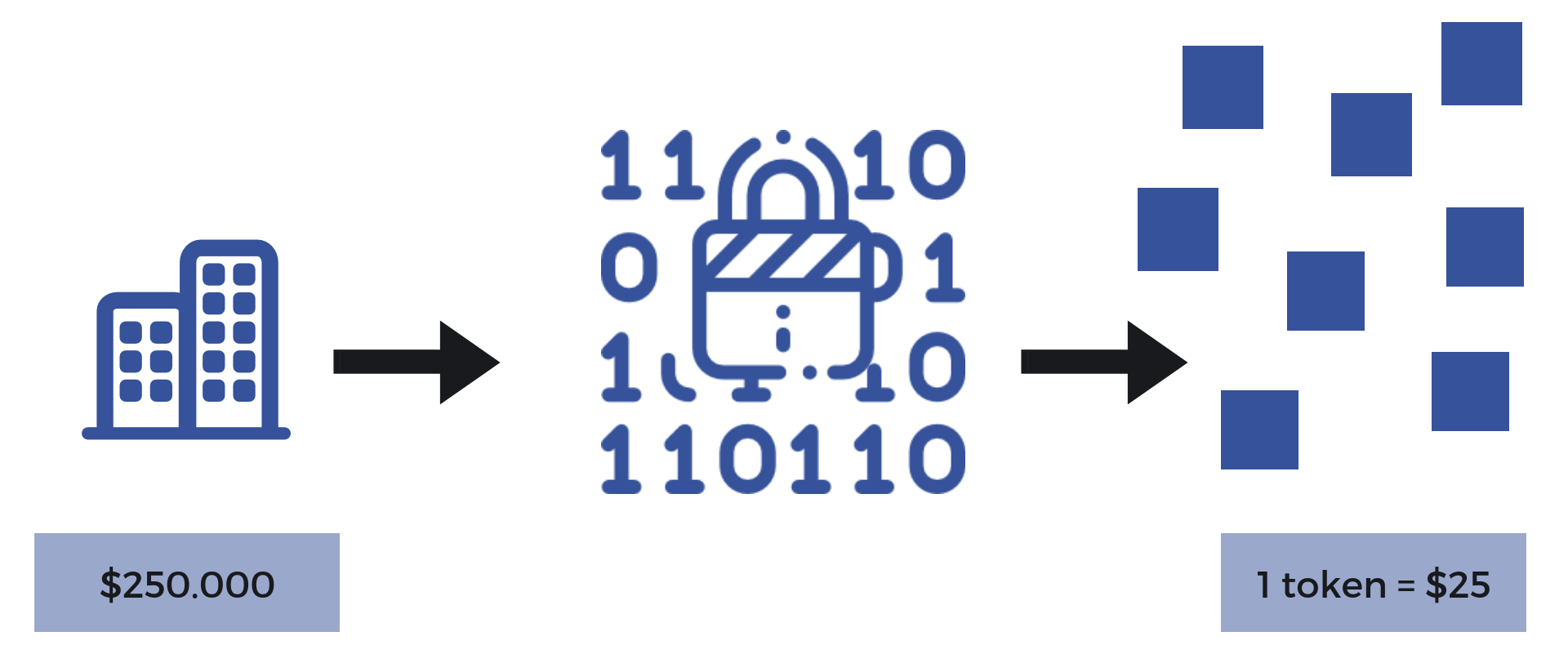

Encryption allows assets to enjoy the benefits of low liquidity without the transactional drawbacks. With encryption, an asset can be represented as millions or even billions of tokens, creating fractional ownership, which can be subsequently listed on a variety of widely available and accessible exchanges. This eliminates the need for costly transactional intermediaries and expands the potential buyer pool while simultaneously preserving the liquidity premium because the tokens are still tied to a unique asset.

Accessibility

Many of the highest-upside assets are out of reach to common investors due to financial or regulatory constraints. For instance, consider financing a big-budget movie: the upfront costs, as well as the risk of a production crew going over-budget, comfortably price out all but the wealthiest investors. However, a successful film can earn a return on the investment multiple times over in a relatively short time frame. Other low-access, high-return examples include collecting sports cars, investing in distressed foreign assets, or the purchase and renting of multifamily real estate.

In this case, the benefits of encryption essentially become similar to crowdfunding, but within a model where the group of investors funding or purchasing an asset also reap the financial rewards of their participation. This allows smaller investors a path towards investing in riskier, but higher-upside assets with relatively low capital.

Transparency

Many high-value assets suffer from a lack of reliable and easily available information regarding returns, ownership history, sale history, and other key metrics investors need to be able to make informed economic decisions. This lack of information is especially acute when evaluating foreign assets, or instances where an investor cannot personally inspect an asset prior to purchase. A key benefit of encryption is that it allows for the open tracking and auditing of all these records due to the fundamentally public nature of many blockchains.

With encryption, investors can see a record of ownership as well as returns in interest or dividends, depending on the smart contract logic of the asset. Additionally, certain assets such as collectibles or racehorses may become more expensive due to celebrity ownership or a rare bloodline. Provenance tracking on the blockchain allows for immutable records, significantly decreasing investment security risks by minimizing record-keeping trust. These features have the potential to significantly reduce the risk of fraud across multiple industries where forgeries and knock-offs are common, such as high-priced luxuries like wine and caviar, as well as fashion and art.

Composability

One of the most promising benefits of asset encryption is also among the least well-explored: connecting the value of real-world assets to the composability of the ecosystem.

Moving forward, asset encryption will allow for a plethora of opportunities for smart contract developers seeking to tap into real-world value. Whole new types of synthetic assets, indexes, and token baskets can easily be built by combining tokens tied to various assets, and the ability to turn real-world revenue streams into collateral offers another jolt of innovation for an already rapidly expanding field.

Why Should Businesses Accept Money 4.0 Now?

Why Should Businesses Accept Money 4.0 Now?